The challenging business environment, changing government

norms & increasing customer expectations tends to hamper the profitability

rate of business. An eternal question of cost reduction in the business

enterprise & putting more projects on hold until the profitability factor

gets stabled.

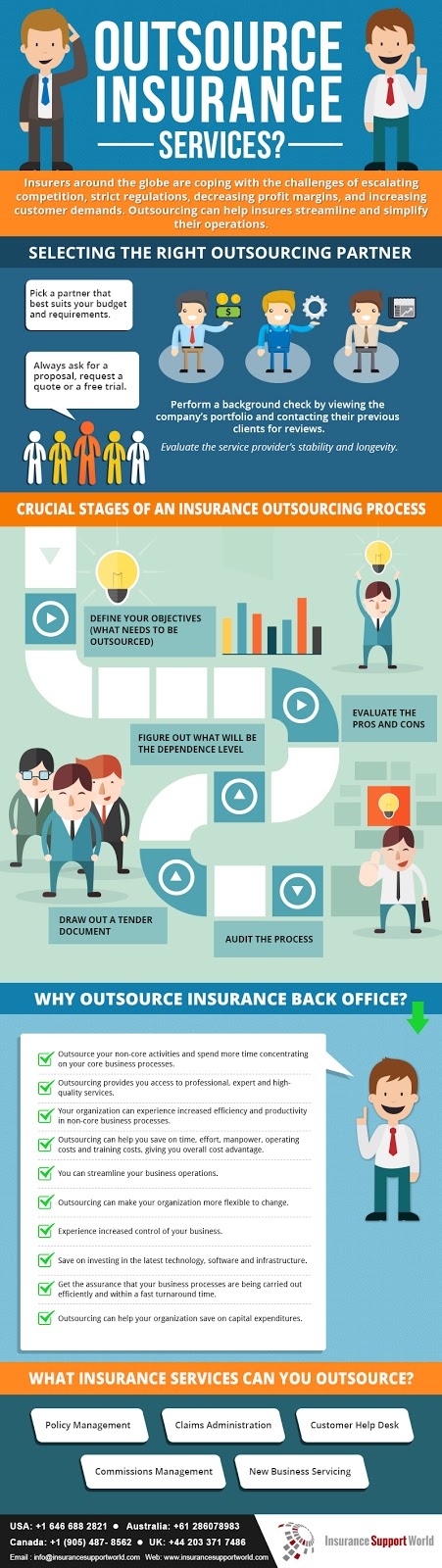

Although these shifts are unstoppable but to comply with these changes, insurers are recognizing their inability to respond to these changes. Why? Aging legacy system, expensive to maintain & difficult to manage insurance back-office tasks is impacting the overall growth of the insurance business.

So outsourcing has emerged as a viable option in the last

few years to serve all these transforming behavior in the insurance sector.

Outsourcing is delivering the business, with the most effective & efficient

solution in the least possible time. Outsourcing services are mainly focused on

optimizing the business, & aimed to deliver high end, business-centric

solutions to generate better output.

Although these shifts are unstoppable but to comply with these changes, insurers are recognizing their inability to respond to these changes. Why? Aging legacy system, expensive to maintain & difficult to manage insurance back-office tasks is impacting the overall growth of the insurance business.

To have a more in-depth look into the insurance outsourcing services, go through this infographic.

|

| Insurance Back Office Outsourcing |

0 comments:

Post a Comment