Insurance policy management is one of the crucial and challenging back office tasks that the insurers have to deal with. In fact, insurance policy administration itself is a combination of a number of tasks that includes quote creation, checking and binding the policies, renewals, preparing the loss run reports, etc. This repetitive back-office operation can put added pressure on the underwriting staff, which ultimately leads to errors.

Generally, in the insurance industry, there is no place for any kind of operational error as they are the security agents for common people, protecting their assets from different risks.

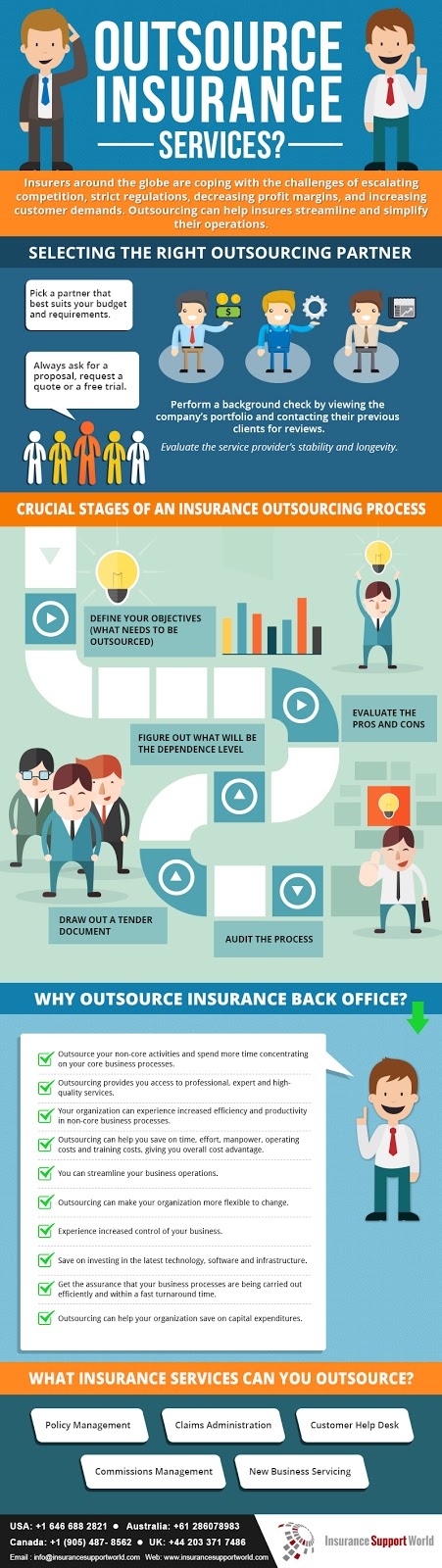

Outsourcing the insurance policy management operations and it certainly is the backdrop of the situation discussed above. While some have felt the need for it, others have used it by analyzing the growth of their competitors via outsourcing. As the cliché goes – ‘If you deprive yourself of outsourcing and your competitors do not, you are putting yourself out of the business.’

Moreover, the benefits of outsourcing insurance policy administration services are immense, which certainly allures the insurers to adopt it.

Here are some of the key benefits of outsourcing insurance policy management:

1. Saves a Lot of Time:

We all know that ‘Time is money’ but as per the modern world ‘time can generate money’, which is exactly what outsourcing do for your business. It saves your time by eliminating the repetitive tasks like policy binding, policy renewal, policy cancelation, etc., and lets you focus on profit and other business issues.

2. Exposure to Latest Technology:

Insurance process outsourcing provides you with one major advantage i.e. technology. The outsourcing providers use the latest technology available in the market to simplify your operations. Modern insurance software is making insurance policy management streamlined than ever before.

3. Skilled Resources:

With the ever-rising technology in the insurance industry, it is becoming important for the employees to keep themselves updated. Because of which, the industry is facing a shortage of skilled resources. Insurance policy management service providers invest in the training and infrastructure for the employees, which can prove to be costly for the insurers. Thus, outsourcing is an ideal way!

4. Cost Reduction:

This is one of the common advantages of most of the outsourcing processes. Outsourcing policy administration or any other back-office operation can help in cutting down the cost drastically. Outsourcing cuts down the need for hiring employees. This ultimately saves a lot of money that goes into salaries, infrastructure, training and more.

5. Risk Reduction:

Outsourcing insurance process outsourcing can reduce business risk also. The market condition along with government regulations and technology can change instantaneously, which increases the risk factor. Outsourcing firms keep you away from this type of risk.

So, the benefits of outsourcing and the trend both suggest that insurance policy management is the demand of the hour. For insurers, it is important that they study the need for their business and outsource as per the demands.

Moreover, it is essential to pick the best outsourcing partner that suit as per the requirement of your insurance business. With years of experience and skilled resources, Insurance Support World is the best pick for insurers looking to outsource their insurance back-office service operations.